Fed’s Upcoming Rate Cut on Inflation and Economic Strategy

The Federal Reserve began its last meeting on December 17, anticipating making a rate cut to deal with continuing economic challenges. Analysts have prepared themselves to see a cut of at least a quarter percentage points on 18 December – a move that will determine the trend of monetary policy in the new year.

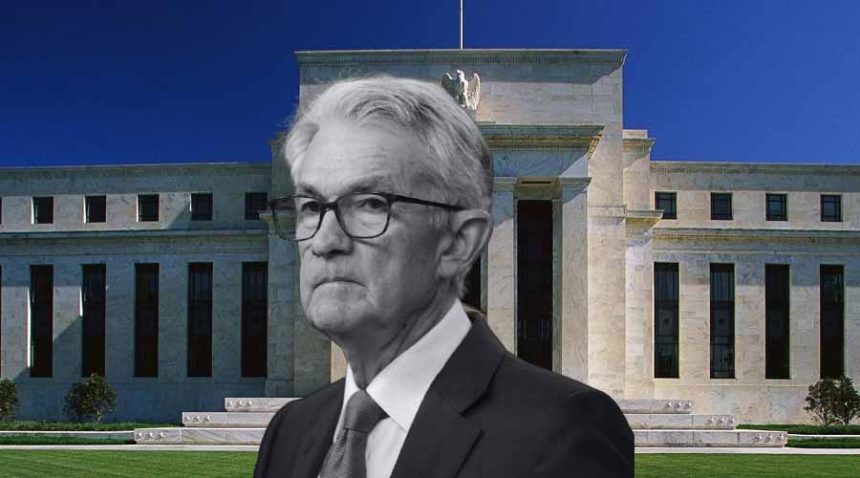

The rate decision will be announced at 2 p.m. Eastern Time. It will be accompanied by a press conference with Fed Chair Jerome Powell, who will perhaps speak further on the Fed’s outlook and the rationale behind its decision-making process.

The Fed has implemented a series of rate cuts this year, with the most recent cut a notable 0.5 percentage point drop in September and another quarter-point cut in November. This week’s cut will bring the total reduction to one percentage point since September as the Fed adapts to changing economic indicators and inflation.

Economic Projections and Inflation Concerns

Furthermore, the Federal Reserve announced its rate decision on December 18. It will release the Summary of Economic Projections (SEP), which gives a peek into the future expectations for the 2025 economy. They anticipate that the figures will show a forecast of three rate cuts for the forthcoming year, down from expectations narrated in September.

This adjustment occurs against the backdrop of the moderate inflation rate, which is still above the Fed’s inflation rate target of 2% per year, as seen from the November Consumer Price Index of 2.7%.

Since the beginning of its hiking process in March 2022, the other significant theme for the Fed has been the fight against inflation. However, the inflation rate has persisted at relatively high levels and still requires constant intervention by the Central Bank. The economic performance has, therefore, changed with a marginal rise in unemployment rates, but consumers’ expenditure is still high, making it challenging for the Fed to advance its approach.

Implications of Upcoming Administration’s Policies

The economic outlook is even clouded by the impending policies of the incoming President of the United States of America, Donald Trump, whose measures outlined are likely to cause an inflationary effect, such as huge tariffs on Mexican, Canadian, and Chinese imported goods.

Such policies may raise consumers’ price levels and affect future decisions regarding the federal funds rate. However, such an approach to monetary policy may exert some pressure on the Fed and make it relatively cautious, which may trigger a deceleration in the rate cuts in 2025 while it evaluates the effects of these new economic policies.