Is the CEO’s mantra, “We’re always 30 days away from going out of business,” shaping the company’s AI-driven business outlook?

Nvidia has become the pioneer of this new-age artificial intelligence. Nvidia shares have grown more than 200% in this year itself. The company’s exponential growth has even landed it a place in the US Dow Jones Index, replacing Intel. Nvidia’s recent earnings and strategic moves justify why they remain aloft and how they are shaping the future of AI.

Let’s explore why and how this chipmaker giant continues to bet on AI to understand its success mantra.

Unprecedented growth: Record-breaking earnings

Nvidia reported revenue for Q3 2024 is a staggering US$35.08 billion, growing by a whopping 94% compared to its previous year’s numbers. Its profits more than doubled to US$19.31 billion from last year’s US$9.24 billion. The AI chipmaker is earning 81 cents a share.

This growth is being fuelled by extraordinary demand for highly specialised GPUs that power large language models and generative AI applications.

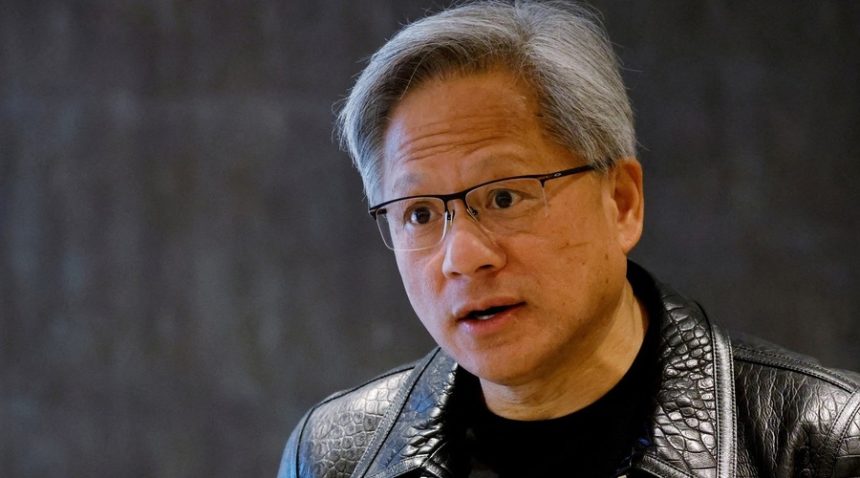

Jensen Huang’s Vision: Betting Big on AI

Nvidia’s co-founder and current CEO, Jensen Huang’s vision has been instrumental in the company’s exponential rise from its 1993 humble beginnings. Jensen Huang’s infamous mantra, “We’re always 30 days away from going out of business,” epitomizes Nvidia’s relentless drive to innovate.

So, it’s no wonder that Nvidia’s GPUs were initially designed for gaming but adapted early to accelerate algorithms on machine learning and AI. This quick adaption to the changing market conditions made all the difference in the company’s success.

“The age of AI is full steam ahead”, according to Huang. The CEO claimed that AI is no longer an emerging technology but an actual transformative power changing industries worldwide. Thus, showcasing why the giant’s betting on AI.

The question, then, naturally arises, will this bet pay off? Read the next sections to understand the company’s strategic moves that led to its success.

Revolutionary Technologies and Strategic Moves

Nvidia’s AI investment has mainly led to its record-breaking success but many other business moves have made it a global leader in the AI sector.

CUDA Advantage: A high point in NVIDIA’s history was its investment in CUDA (Compute Unified Device Architecture) software. CUDA optimises the GPU for AI applications. So, it is the technology of choice for any developer and researcher working with Nvidia hardware. This has given the lead in AI market shares to NVIDIA.

Data Center Revenue: Revenue from Nvidia’s AI data centers grew 112% to US$30.8 billion. It has now become a go-to supplier for cloud providers and large enterprises that are pouring their dollars into AI technologies.

Hopper and Blackwell GPUs: These Next-Generation Chips Have Become the Cornerstone of AI Computing. Scheduled for a launch in fiscal 2025, Nvidia’s Blackwell GPUs are expected to emerge as the dominant force in AI hardware. This is Propelling Nvidia’s share price and market valuation to never-seen-before success.

Edge Computing: Nvidia is looking to expand further than just being an AI hardware company. The chipmaker has developed cutting-edge AI technologies for self-driving cars and robotics applications.

Strategic Acquisitions

Acquisitions have been crucial in promoting Nvidia’s growth:

Mellanox Technologies: Acquired for US$6.9 billion in 2019, Mellanox bolstered Nvidia’s data center capability which is pivotal for AI hardware manufacturing.

DeepMap: NVIDIA acquired this to add its capabilities in terms of autonomous vehicle mapping and navigation.

Grace CPUs: These complement Nvidia GPUs, providing integrated solutions for AI-powered systems

The Competition Heats Up

Despite dominating the landscape, Nvidia faces stiff competition in the AI hardware market.

Tech giants: Nvidia’s biggest consumers, Google, Microsoft, and Amazon are all developing in-house processing units or custom silicon to avoid dependency on NVIDIA’s GPUs.

Emerging Competitors: AMD, Cerebras, and Graphcore are working on new concepts to capture the bigger part of the market.

According to Jensen Huang, this is a real competition. He asserted, “Giant companies [are] pursuing the same giant opportunity.” For NVIDIA to remain on top of this competitive and dynamic field, it needs to innovate further and collaborate with strategic partners to remain at the top. Thus, Nvidia’s focus on continue to bet on AI technologies to maintain its competitive edge.

Relationship Building: Ecosystem Expansion

Another reason for the company’s success and current business outlook is its partnerships, collaborations, and relations with key market leaders. Nvidia has developed strong partnerships to expand its base:

Microsoft Azure: Nvidia provides the vast majority of GPUs that drive Microsoft’s AI services, enabling it to train and deploy AI models.

OpenAI: Nvidia’s GPUs provided the backbone that trained pioneering AI models such as ChatGPT.

Automotive Partnerships: Companies like Mercedes-Benz and Volvo leverage the Nvidia Drive platform for their self-driving vehicles.

Omniverse: Nvidia’s Omniverse is a new 3D collaboration platform that supports players such as Adobe, Autodesk, and Epic Games, combining simulations, AI, and real-time graphics.

Why Nvidia’s AI Bet Will Pay Off

NVIDIA’s strategy is not a roll of the dice, nor is it a well-thought-out, market and technology-demand-driven maneuver. The company is therefore rightly assuming a large share of the annual US$100 billion accelerated computing market.

AI adoption by every industry has made Nvidia’s GPUs indispensable for training and deploying advanced models. Innovation and adaptability surely made Nvidia a company that competes as well as keeps abreast with the best in business.

Conclusion

Embracing calculated paranoia and leveraging strategic partnerships, acquisitions, and groundbreaking technologies, Nvidia has transformed itself into an AI revolution powerhouse. Nvidia’s visionary leadership, drive for innovation and market dominance make it an unstoppable force in computing’s future.