The Trump administration may cut tariffs on Chinese goods from 145% to 50–65%, depending on the outcome of ongoing trade talks with Beijing

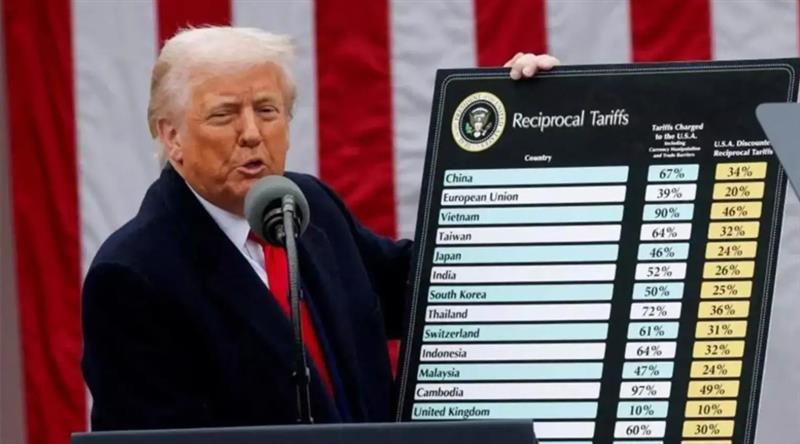

Officials within the Trump administration are considering reducing Chinese import tariffs from 145% to 50% to 65%. According to sources who follow developments in this area, the tariff modifications are pending the completion of ongoing trade negotiations with China. According to sources from The Wall Street Journal, White House advisers are developing a complex tariff system.

According to an official plan, non-sensitive imports would be subject to 35% tariffs, whereas strategically essential goods, including semiconductors and rare earth materials, would remain taxed at rates exceeding 100%. The new structure will take effect in five years, according to the administration’s timeline to establish a balance between national defense and economic performance.

Trump Signals Flexibility on Tariff Rates

According to reported statements, President Donald Trump stated that trade tariffs would decrease substantially after an agreement was reached with Beijing. Trump noted that the planned tariff rate will not reach the 145% he mentioned before. He noted that the administration aims to negotiate a fair agreement with China by maintaining open dialogue with Chinese officials.

The President made these remarks right after his country increased tariffs steeply this month. An increase to 145% defined the new average tariff rates on imported Chinese goods following U.S. officials’ implementation of massive trade duties because of concerns regarding trade imbalances and national security issues. In response, China implemented import tariffs exceeding 125% on American products.

After the government raised the import tariff rates, numerous high-tech sectors received short-term exemptions from U.S. trade duties. Smartphones, personal computers, and semiconductors are exempt from reaching the highest possible tariff levels. The White House administration has done so at present, but it declared that the benefits might disappear eventually.

Global Trade Impact and Market Response

The U.S.-China trade dispute impacts worldwide distribution channels and market equilibrium. The proposed removal of tariffs would reduce the market strain while making trade collaboration possible. The recent week brought optimism about trade policy development, which led to Wall Street market growth.

President Trump’s declaration of universal tariffs triggered over 100 countries to express interest in conducting trade agreements with America. The changing global trade landscape is confirmed by formal proposals submitted by eighteen countries from the interested nations. Throughout the negotiations, the administration explored multiple potential tactics to achieve its goals. Sources indicate the administration supports lowering tariffs as its primary approach to pursuing its trade mandate.