Explore the latest trends in MicroStrategy Stock Price as it hits $443.35, driven by Bitcoin’s rally

MicroStrategy Incorporated (NASDAQ: MSTR) has become one of the most prominent players in the intersection of enterprise analytics software and cryptocurrency investments. Known for its strategic focus on Bitcoin accumulation, the company’s stock performance reflects a unique blend of technology sector fundamentals and cryptocurrency market dynamics. This article provides a detailed technical analysis of MicroStrategy stock, highlighting price movements, financial performance, and key metrics.

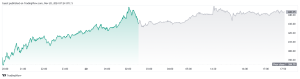

Stock Price Performance

MicroStrategy stock has demonstrated significant volatility, closely mirroring Bitcoin’s price trajectory. On November 20, 2024, MSTR traded at $443.35, marking a notable increase from its previous close of $384.79. The intraday chart showcases strong upward momentum, driven by positive market sentiment and Bitcoin’s recent rally.

Key observations:

Intraday Movement: MSTR opened at $400 and reached a peak of $450 before stabilizing around $443. This reflects a bullish trend fueled by Bitcoin’s price action.

Volume Activity: Increased trading volumes indicate growing investor interest, correlating with broader cryptocurrency market dynamics.

Support and Resistance Levels: Key support is observed near $400, with resistance at $450. A breakout above $450 could signal further upward momentum.

Revenue and Profitability

MicroStrategy’s financial performance remains a critical aspect of its stock analysis. The company’s revenue growth is modest, driven by its software business, but profitability is heavily influenced by its Bitcoin holdings.

Revenue and Net Income Trends:

In 2023, MicroStrategy reported revenue growth of $600 million, maintaining steady performance in its enterprise software segment.

Net income showed substantial fluctuations due to Bitcoin’s price volatility, with periods of unrealized gains and losses.

Margin Analysis:

Gross profit margins remain stable, thanks to its high-margin software business.

Net margins are volatile, often swinging from positive to negative depending on Bitcoin’s valuation.

Debt and Liquidity

MicroStrategy’s aggressive Bitcoin acquisition strategy has significantly impacted its debt levels and liquidity.

Debt Levels: The company has raised substantial debt through convertible bond offerings to fund Bitcoin purchases. In 2023, total debt reached approximately $2.8 billion.

Cash and Equivalents: Despite high debt, MicroStrategy maintains sufficient liquidity, with cash reserves bolstered by software revenue.

Free Cash Flow: Free cash flow remains constrained due to interest payments and ongoing Bitcoin purchases.

Technical Indicators

A closer look at technical indicators provides insights into MicroStrategy’s stock movement:

Oscillators:

Relative Strength Index (RSI): At 47.86, RSI indicates a neutral zone, suggesting neither overbought nor oversold conditions.

Momentum: Negative momentum (-6.33) highlights a need for caution, despite recent upward movements.

MACD Level: A bearish signal with a value of -0.52, indicating potential short-term weakness.

Moving Averages:

Short-term moving averages (10-day, 20-day) are below the current price, supporting a bullish sentiment.

The 200-day exponential moving average at $411.88 acts as strong support, confirming a longer-term upward trend.

Ichimoku Cloud:

The base line at $422 suggests a consolidation phase, with potential for a bullish breakout.

Bitcoin Correlation

MicroStrategy’s stock price is closely tied to Bitcoin’s performance due to its status as one of the largest corporate Bitcoin holders. The company’s Bitcoin holdings exceed 331,000 BTC, valued at over $10 billion as of November 2024. Key implications of this correlation include:

Leverage on Bitcoin Rally: MSTR often amplifies Bitcoin’s price movements, providing higher returns during bullish cycles.

Risk Exposure: Sharp Bitcoin corrections significantly impact MicroStrategy’s stock price, increasing volatility.

Revenue Conversion and Earnings Analysis

MicroStrategy’s quarterly financial results reveal critical insights into its operational efficiency and profitability:

Revenue-to-Profit Conversion:

Operating income remains positive, but non-operating expenses linked to debt servicing weigh on net income.

Tax expenses are manageable, contributing to stable cash flow.

Earnings Trends:

EPS (Earnings Per Share) varies widely due to unrealized Bitcoin gains/losses. The next earnings report, scheduled for February 4, 2025, is expected to reflect Bitcoin’s recent rally.

Debt Coverage and Risk Assessment

MicroStrategy’s aggressive financial strategy has raised questions about its risk exposure:

Interest Coverage Ratio: Adequate, thanks to consistent software revenue streams.

Debt-to-Equity Ratio: Elevated, indicating higher financial leverage and dependence on Bitcoin’s valuation.

Risk Mitigation: Bitcoin holdings act as both an asset and a liability. Price appreciation improves the balance sheet, while price drops increase debt coverage pressure.

Comparative Analysis

MicroStrategy’s performance is benchmarked against peers in the software and cryptocurrency sectors:

Technology Peers:

Traditional software companies like Adobe and Oracle exhibit stable revenue growth and lower volatility compared to MSTR.

Crypto-Linked Stocks:

MSTR outperforms most crypto-mining firms in terms of market capitalization and liquidity, but its risk profile remains higher due to leveraged Bitcoin exposure.

Outlook and Predictions

MicroStrategy’s future hinges on two primary factors: Bitcoin’s market trajectory and its ability to sustain software revenue growth. Key predictions include:

Short-Term Outlook: Continued upward momentum if Bitcoin surpasses $50,000, with MSTR targeting $500.

Long-Term Outlook: Dependent on macroeconomic factors and regulatory clarity around cryptocurrencies. A prolonged Bitcoin bull market could position MSTR as a high-growth stock.

MicroStrategy stock offers a unique investment opportunity, blending enterprise software stability with cryptocurrency market potential. While its aggressive Bitcoin strategy introduces significant volatility, it also provides substantial upside during bullish cycles. Investors should closely monitor Bitcoin’s performance, financial leverage, and upcoming earnings reports to make informed decisions. With its current trajectory, MSTR remains a compelling choice for risk-tolerant investors seeking exposure to the dynamic intersection of technology and digital assets.